NAFTA Preference Criterion Code

NAFTA preference criteria

The NAFTA preference criteria designated by the letters “A” through “F” (PIES uses "A" through "D") show how your products qualify for a NAFTA tariff rate and tell customs authorities and the importer how the goods qualify for preferential treatment under NAFTA (North American Free Trade Agreement).

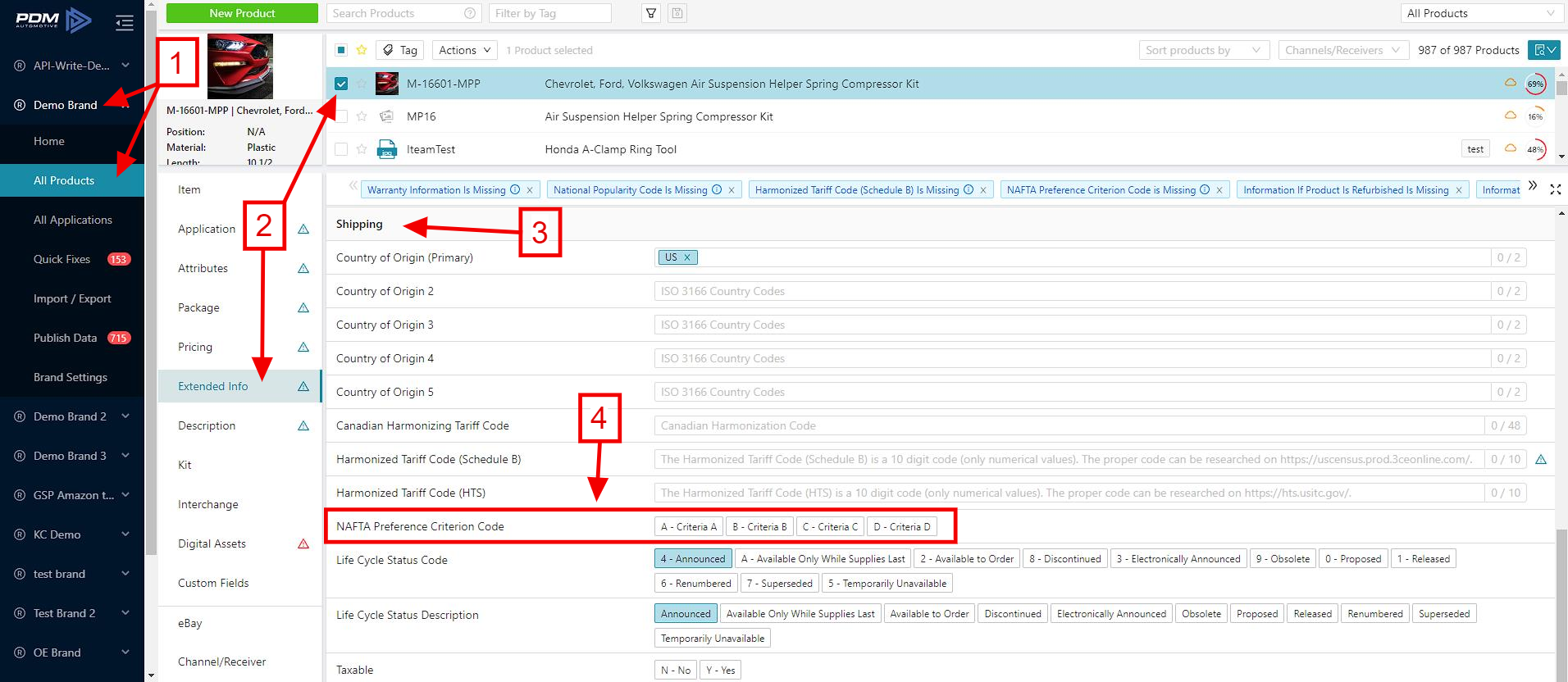

Access the NAFTA Preference Criterion Code:

1. Click on a Brand, and select All Products.

2. Select one or more products from the Catalog, and click on the Extended Info segment.

3. Scroll down to the Shipping options list.

4. Here you can select one of the NAFTA Preference Criterion Code.

Preference Criterion A

2. Select one or more products from the Catalog, and click on the Extended Info segment.

3. Scroll down to the Shipping options list.

4. Here you can select one of the NAFTA Preference Criterion Code.

Preference Criterion A

Corresponds to goods wholly obtained or produced entirely in Canada, Mexico, or the United States.

For goods to qualify under this criterion, they must contain no non-North American parts or materials anywhere in the production process. It is generally reserved for basic products such as those harvested, mined, or fished in the NAFTA territory, although it would include a manufactured good with no non-NAFTA inputs. As a general rule, however, Preference Criterion A rarely applies to manufactured goods. If the good contains any non-NAFTA materials, it will not qualify under Preference Criterion A.

Preference Criterion B

Even if your good contains non-NAFTA materials, it can qualify as B if the materials satisfy the Rules of Origin. The Annex 401 Rules of Origin are based on a change in tariff classification, a regional value-content requirement, or both.

The updated Rules of Origin are located in HTSUS (Harmonized Tariff Schedule of the United States) General Note 12(t) of the NAFTA Agreement. Preference Criterion B is used when the good being certified is produced using materials that the producer/exporter is unable to prove to qualify as originating goods in their own right. The finished product will be originating if the requirements of the applicable rule of origin are met. The requirements of the NAFTA Rules of Origin differ from good to good.

Preference Criterion C

This criterion corresponds to goods produced entirely in Canada, Mexico, and/or the United States exclusively from NAFTA materials. This is used when the producer/exporter is able to document that the finished good is produced entirely in the NAFTA territory using only materials that would qualify in their own right. The producer/exporter should have documented proof that every raw material and component is a NAFTA good.

Preference Criterion D

In very few cases, a good that has not undergone the required tariff transformation can still qualify for preferential NAFTA treatment if a regional value content requirement is met.

Related Articles

Life Cycle Status Code & Description

Access the Life Cycle Status Code & Description Life Cycle Status Code & Description are accessible through the Extended Product Information Segment. 1. In the All Products tab, Select one or more product(s) and click on the Extended Info segment. 2. ...Extended Product Information Segment

Extended Product Information Segment Overview The Extended Product Information can be referred to as EXPI or Extended Info. The EXPI segment contains predefined product attributes that are not already included in the Attributes segment. Examples of ...Harmonized Tariff Code

Harmonized Tariff Code The Harmonized Coding System (HS) is an international goods classification system. Tariff Codes are used to classify products for statistics but also to determine tariff rates for these products to be traded between countries. ...National Popularity Code & Description

Access the National Popularity Code & Description National Popularity Code & Description are accessible through the Extended Product Information Segment. 1. In the All Products tab, Select one or more product(s) and click on the Extended Info ...Editing EXPI Values for Multiple Products

Editing EXPI Values for Multiple Products It's easy to edit the Extended Product Information / EXPI Segment values for multiple products simultaneously. In the All Products tab, select one or more product(s) from the catalog and click on the Extended ...